What keeps entrepreneurs awake at night is the fear of bankruptcy, even if, financially, we are doing just fine. Bankruptcy appears so final.

As a lawyer, if I’m bankrupted, professionally I’m finished, for I will be disbarred from practising. And in Quakerism, historically any bankrupt Quaker was ejected from the society.

Wearing all three hats, the threat of bankruptcy is intense, suffocating, never-ending.

The definition of a bankrupt is, of course, someone who cannot pay their debts; whose finances are exhausted. At first glance, therefore, superficially a bankrupt is financially eviscerated and made a pariah.

But that is too simplistic. In Silicon Valley, it is said that if the founder of OpenAI (Chat GPT), Sam Altman, was to start a new company tomorrow with no money, due to his skillset, experience and contacts, his new business would start life as a unicorn – that is, it would have an instant valuation of $1 billion, even without products, services or employees. The same would be true even if Mr Altman had been bankrupted.

And this is true for you. If you embark upon an entrepreneurial journey, I guarantee that you will learn a bunch of stuff and make a load of fantastic contacts. What you will learn in one month in business will outweigh what any MBA programme could teach you in one year. And even if your business collapses and you are bankrupted, you are not finished. Like in a computer game, you will respawn.

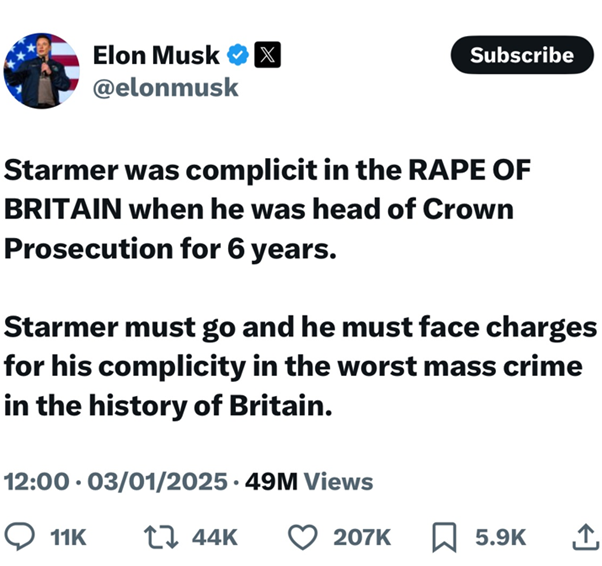

I know that many people, particularly entrepreneurs, frequently calculate their net worth – i.e. the total of all their financial assets. When performing this crude calculation, only financial firepower is totted-up. But this logic is flawed. When it is said that Elon Musk has a net worth of however many billions it is, this will be a gross underestimate of his real net worth, given his intellect, experience and contacts. This logic holds true for a “failed” entrepreneur, too.

But there is even more to add to the net worth calculation: our health, family relationships, personal relationships, business relationships, skills and experiences, all combined, represents our true net worth. Of course, it’s impossible to calculate the value of a particular relationship and that’s why things which are easily quantified – say, our pension pot– are often given greater weight than any intangible.

This error in logic and computation is neatly described by the McNamara Fallacy, named after Robert McNamara, the U.S. Secretary of Defence during the Vietnam War. The McNamara Fallacy refers to a logical mistake of relying solely on quantitative observations, while ignoring or undervaluing qualitative factors. The McNamara Fallacy occurs when decisions are based predominantly or exclusively on measurable data, under the assumption that what can be quantified is inherently more valuable or accurate than what cannot be measured.

As with the net worth calculation today, this focus on financial power oftens leads to misinformed decision-making. Erroneously and sadly, many people do not embark upon an entrepreneurial journey, because they place no or little value on the personal value that the experience guarantees to provide.

Therefore, if you are performing the somewhat cringey net worth calculation (which I know will make some readers squeamish), make sure that you give precedence to qualitative data. And if contemplating an entrepreneurial journey, when calculating your risk of bankruptcy, remember that your experience and memories will never be expunged, even if you are financially ruined in the short term. And if you take the plunge, I guarantee that you will have a great story to tell, and one fewer item on your bucket list.

(If you, or someone you know, needs guidance with a business, I’m here to assist as a business advisor, or as a non-executive director, or mentor. Think of me as an ‘ethical consigliere.’ Please reach out for an exploratory conversation to see how we can work together. Extreme candour guaranteed!)