If I were dictator of Planet Earth for one glorious hour, I’d make two immediate laws. No dithering, no committees, no focus groups. Banning rugby did cross my mind, but, no – I wouldn’t waste my hour on that. Instead, I’d use my supreme rule to fix how the world understands money and economics. (Redistributing wealth also tempted me, but that would detract from my blog.)

First, as all-powerful Supreme Leader, I’d rename Modern Monetary Theory (MMT) to Modern Monetary Reality (MMR – though I admit the acronym needs work!). After all, calling it a ‘theory’ makes it sound debatable, when it’s really just how major economies function.

My second law: nobody is allowed to vote until they can prove they understand the tenets of MMR. You don’t have to agree with it – just know how it works. So, according to me, 10-year-olds could vote, but only if they understood MMR.

In case you’re scratching your head (and therefore shouldn’t be voting!), MMR argues that governments which issue their own currency can’t “run out of money” like households or businesses can. They can always create more. According to MMR, the primary constraint on government spending isn’t budget deficits – it’s inflation.

Take the 2% inflation target most governments, including the UK, obsess over. Its origin? Entirely arbitrary. In the 1980s, a New Zealand chancellor, cornered for a target, blurted out “2%.” No groundbreaking research, no Nobel-worthy insight. Just a random number that stuck – and now dictates global economic policy.

And then there’s national debt – the eternal bogeyman. The UK hasn’t been debt-free since 1694, when we borrowed money to fight the French. Over 300 years later, we’re still here. Why? Because a country’s finances are nothing like a household budget – no matter what certain politicians claim. Households must live within their means; countries with their own currency do not. Especially G8 countries.

Governments can create money. Repeat after me: “Governments can create money”.

That’s exactly how furlough schemes and dodgy Covid contracts were funded. The real economic constraint isn’t debt – it’s inflation: otherwise known as the Cost of Living Crisis, which we are all experiencing.

This leads to the fundamental question: what is the purpose of an economy? If it’s to serve people, why do we let debt hysteria dictate policies? If governments embraced MMR, the benefits would be enormous. Imagine well-funded hospitals, thriving schools, and bold climate action – all without debt hysteria holding us back. MMR shifts the question from “where does the money come from?” to “do we have the resources?” and “can we control inflation?”

If we have enough doctors, teachers, and supplies, why ration healthcare or education? By all means, Dear Reader, you are more than entitled to argue for a smaller state or minimal redistribution, if that’s your view. But don’t base your arguments on a misunderstanding of MMR.

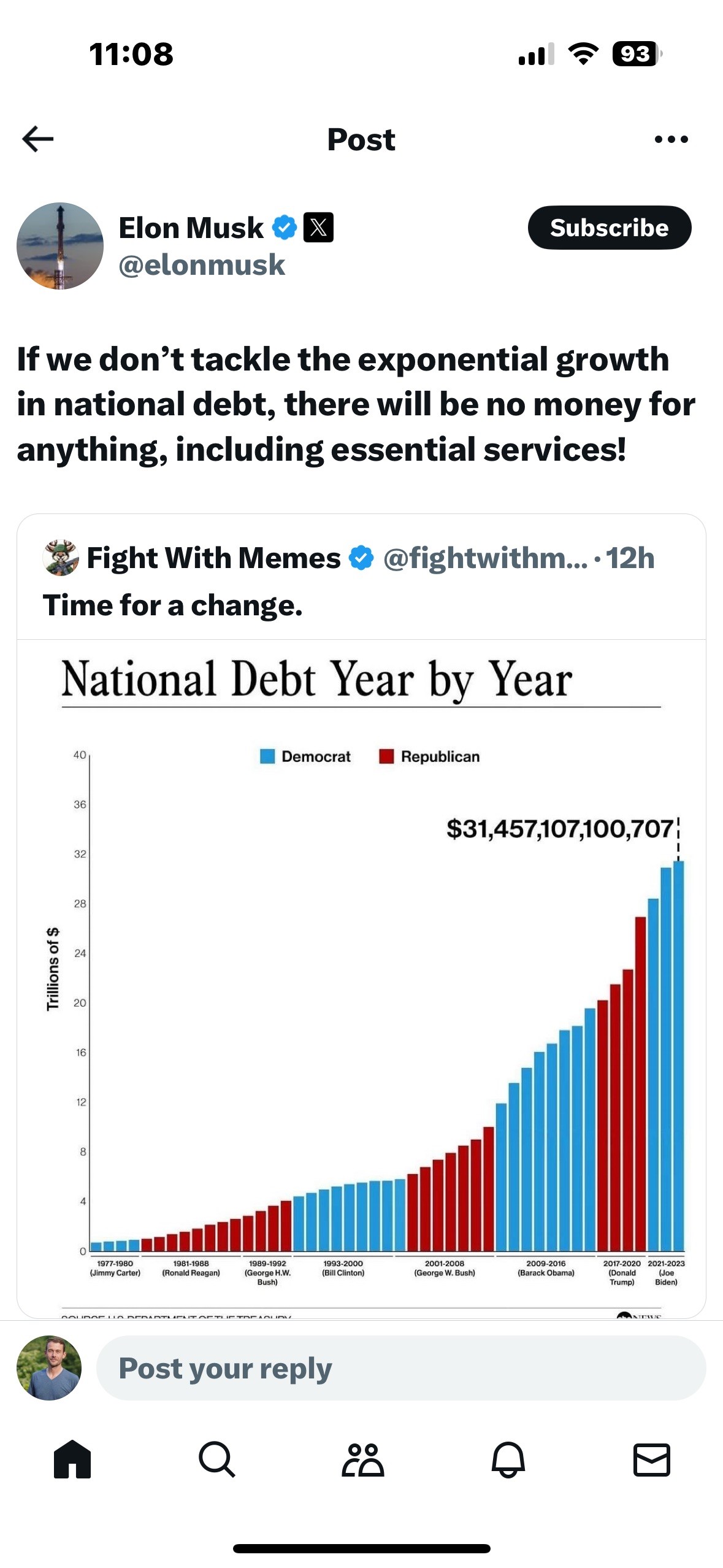

The re-election of Trump looms large in this debate. Elon Musk (self-proclaimed “New First Lady”) and the forthcoming Department for Government Efficiency (DOGE) plan to take a sledgehammer to US state apparatus, all over fears of rising debt – which stands at $36,000,000,000,000 – (36 trillion). But that fear ignores MMR – and how modern economies really work – and that the US has been in debt ever since its formation.

If I were dictator for an hour, I’d make sure we understand what we’re voting for — because only then can we shape the country we truly want to live in.